Ostin Technology Group Reports Half-Year Financial Results

Nanjing, China, August 19, 2022 (GLOBE NEWSWIRE) -- Ostin Technology Group Co., Ltd. (the "Company") (Nasdaq: OST), a supplier of display modules and polarizers in China, today reported its unaudited financial results for the six months ended March 31, 2022.

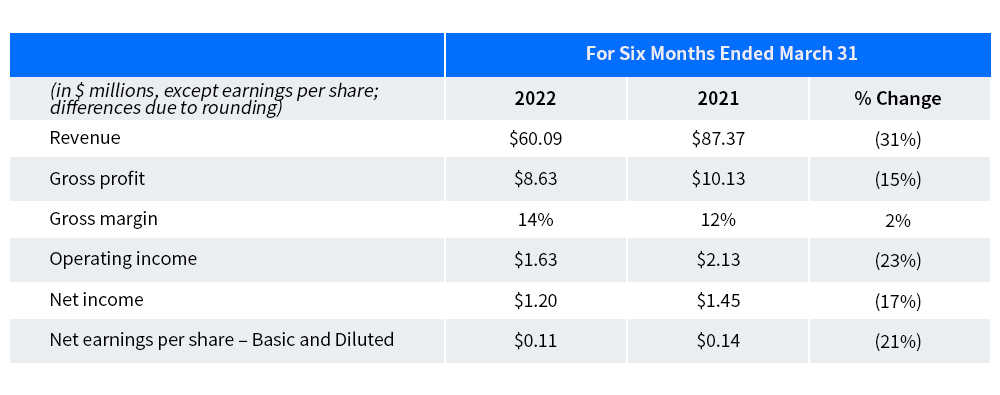

Half-Year Ended March 31, 2022 Summary:

· Revenue declined by 31% to $60.09 million for the six months ended March 31, 2022, from $87.37 million for the same period in 2021;

· Gross margin grew to 14% for the six months ended March 31, 2022, from 12% for the same period in 2021;

· Operating income decreased by 23% year-over-year to $1.63 million for the six months ended March 31, 2022, from $2.13 million for the same period in 2021;

· Net income was $1.20 million for the six months ended March 31, 2022, compared to $1.45 million for the same period in 2021;

· Earnings per share was $0.11 for the six months ended March 31, 2022, compared to $0.14 for the same period in 2021;

· Cash and cash equivalents grew to $3.53 million at March 31, 2022, from $2.14 million at March 31, 2021.

Mr. Tao Ling, Chairman and CEO of the Company commented: “Despite a decrease in revenue for the six months ended March 31, 2022 amid the continuous lockdown in mainland China and the challenging global supply chain disruptions, we are able to deliver high quality products and services thanks to our dedicated workforce and focused innovation. We have demonstrated the resilience of our business in a challenging environment and continued investing our efforts in key geographies and advanced technologies. With the recent lauch of new products and services and business initatives, we expect to expand our customer base and continue to increase our competitiveness on the market.”

Results of Operations

Revenues

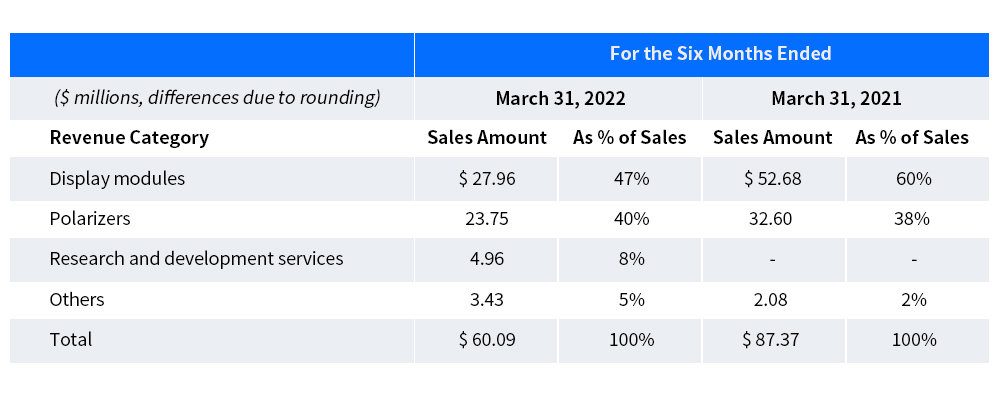

The following table presents revenue by major categories for the six months ended March 31, 2022 and 2021, respectively.

Revenues decreased by approximately $27.28 million or 31%, to approximately $60.09 million for the six months ended March 31, 2022 from approximately $87.37 million for the six months ended March 31, 2021. The decrease in revenues was primarily due to the decrease in revenue from both display modules and polarizers resulting from the continuous lockdown in mainland China from late 2021 to the first quarter in 2022.

· Revenue from display modules decreased by approximately $24.72 million or 47%, to approximated $27.96 million for the six months ended March 31, 2022 from approximately $52.68 million for the six months ended March 31, 2021. Based on seasonality in the Company’s business and cyclical nature of its industry, the Company believes that the market demand will gradually recover in the second half of 2022 and believes the Company’s sales of display modules will boost in the next 12 to 18 months.

· For the six months ended March 31, 2022 and 2021, revenue generated from the polarizers were approximately $23.75 million and $32.60 million, respectively, representing a decrease of approximately $8.85 million or 27%. Due to the long duration of the epidemic, customer demands for consumer electronics was met in the first two years of the epidemic, and such demand decreased in the six months ended March 31, 2022 which resulted in the decrease in sales of the Company’s polarizers.

· Revenues from repair services increased by approximately $1.34 million, or 64%, to approximately $3.43 million for the six months ended March 31, 2022 from approximately $2.08 million for the six months ended March 31, 2021. The Company extended repair services customer base also to those who did not purchase display panel products during the reporting period.

· For the six months ended March 31, 2022, revenue generated from the Company’s new research and development services was approximately $4.96 million, representing 8% of its total revenues.

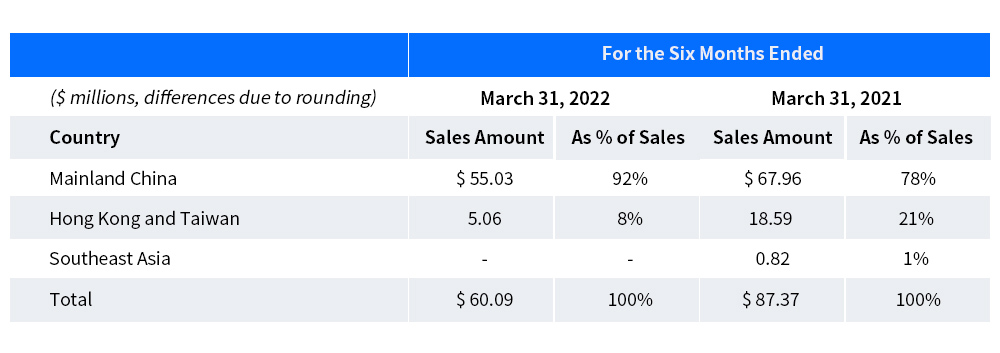

The following table lists the Company’s revenues by geographic region for the six months ended March 31, 2022 and March 31, 2021. To mitigate impact of the fluctuation of exchange rates and shipping disruption caused by the epidemic, the Company shifted more sales to domestic markets, and therefore, the Company’s sales to Hong Kong and Taiwan decreased significantly during the six months ended March 31, 2022 as compared to the same period last year.

Cost of revenues

Cost of revenues decreased by approximately $25.78 million or 33%, to approximately $51.46 million for the six months ended March 31, 2022 from approximately $77.24 million for the six months ended March 31, 2021. The decrease in total cost of revenues was in line with the Company’s decreased revenue.

Gross profit margin

Overall gross profit margin was 14% for the six months ended March 31, 2022, as compared to 12% for the six months ended March 31, 2021. The increase in gross profit was mainly due to the fact that the Company’s new research and development services had a higher gross margin.

Selling and marketing expenses

Selling and marketing expenses decreased by approximately $0.99 million, or 41%, to approximately $1.42 million for the six months ended March 31, 2022, as compared to approximately $2.41 million for the six months ended March 31, 2021. The decrease in selling and marketing expenses mainly was mainly due to (i) the decrease in revenue and (ii) decrease in sales commissions for market development attributable to stabilization of new customers developed in the past two years.

General and administrative expenses

General and administrative expenses increased by approximately $0.86 million, or 32%, to approximately $3.55 million for the six months ended March 31, 2022, as compared to approximately $2.69 million for the six months ended March 31, 2021. The increase in G&A expenses was due to the increase in professional fees during the Company’s IPO process and the increase in administrative expenses in complying with regulations imposed by local government to control COVID-19.

Research and development expenses

The Company’s research and development expenses decreased by approximately $0.97 million to $2.03 million for the six months ended March 31, 2022 from approximately $3.00 million for the same period in 2021. The decrease was mainly attributable to the COVID-19 situation. On the one hand, the shipping was delayed and the materials needed for the Company’s research and development were not delivered in time; on the other hand, the Company’s employees, including research and development staff, had to stay at home for months due to the COVID-19 lockdown and quarantine requirements of the PRC local governments where the Company’s employees are based in. As a result, some of the Company’s research and development projects were either suspended or slowed down and therefore the Company incurred less research and development expenses.

Net income

As a result of the foregoing, the Company recorded net income of $1.20 million and $1.45 million for the six months ended March 31, 2022 and 2021, respectively.

Cash and cash equivalents

Cash and cash equivalents were $3.53 million as of March 31, 2022, as compared to $2.14 million as of March 31, 2021.

More Nasdaq information please visit:http://ostin-technology.com/

Publication Date:2022.08.19